*this article was orignially published July 14, 2024*

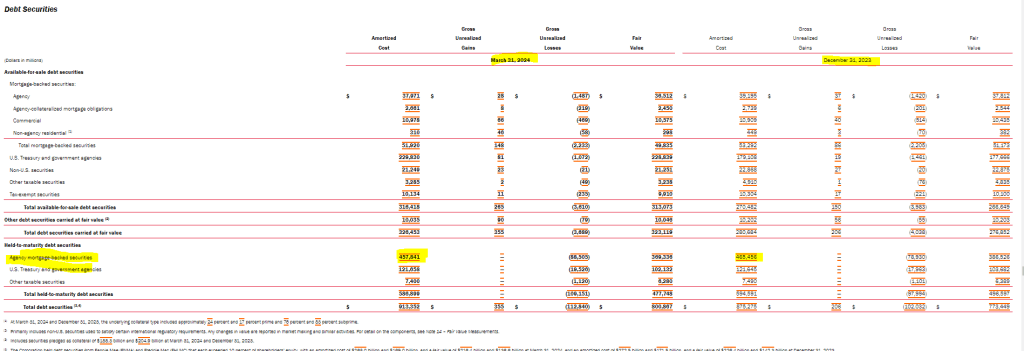

Bank of America ($BAC) often draws outsized criticism, especially across finance and crypto communities on platforms like Twitter/X. A quick search of the $BAC cashtag reveals constant calls for doom—particularly around earnings season or macro stress events. Much of this skepticism centers on a specific accounting issue: Bank of America’s large held-to-maturity (HTM) portfolio of agency mortgage-backed securities (MBS), which has, at times, shown over $100 billion in unrealized losses on a mark-to-market basis.

Despite this negative sentiment, Bank of America is the second-largest position in my equity portfolio.

Why the Bearish Sentiment?

BAC represents traditional banking, and that alone makes it a target in today’s fintech-driven narrative. Ironically, BAC executes many fintech functions more reliably than the startups that criticize it—many of which depend on traditional infrastructure behind the scenes. Crypto enthusiasts, too, often view large banks as barriers to the adoption of digital assets and cheer on any perceived weakness.

However, the crux of the bearish case typically revolves around the accounting treatment of BAC’s HTM securities and the hypothetical risk that a deposit run—like the one that toppled SVB—could force the bank to realize large losses.

Is BAC Vulnerable?

In theory, yes—any bank forced to liquidate long-duration assets during a crisis could face steep losses. But Bank of America is not SVB. Its deposit base is far larger, more diversified, and more stable. In times of market stress, deposits tend to flow toward systemically important banks like BAC, not away from them.

The current situation stems from the early pandemic period. The U.S. government injected trillions into the economy while consumer spending and business investment stalled, leading to a surge in bank deposits. BAC alone saw about $1 trillion in inflows. Lacking lending opportunities, the bank allocated roughly half of this capital to short-term instruments and the other half to long-term agency MBS.

The Impact of Rate Hikes

This MBS portfolio—currently around $458 billion—was mostly purchased when yields were just above 2%. With the Federal Reserve’s aggressive rate hikes, the market value of those bonds has dropped, creating large unrealized losses.

But under IFRS, HTM securities don’t need to be marked to market as long as the bank intends to hold them to maturity. These are government-backed assets, and unless forced to sell, BAC can ignore those paper losses. This frustrates critics, but it’s standard accounting. These losses aren’t economically meaningful unless liquidity dries up—which, again, is highly unlikely for a bank like BAC.

A Hidden Advantage

Here’s what many critics overlook: Bank of America’s long-dated MBS portfolio could become a structural tailwind as rates remain elevated.

Roughly $10 billion of these HTM securities mature or are prepaid every quarter. That capital is now being reinvested in instruments yielding over 5%—primarily T-bills. This represents an uplift of over 3 percentage points versus the original MBS yield.

At ~$40 billion reinvested annually, BAC effectively improves its net interest income each quarter—without any operational change.

Over a decade, this rotation could increase earnings per share (EPS) by roughly $0.14 per year, assuming stable rates. This is a material tailwind for a bank with stable operations, a growing deposit base, and the ability to repurchase shares.

What I’m Doing

My average cost on BAC is around $28. I increased my position substantially during the 2023 panic after SVB’s failure, when BAC briefly traded near $25. At current levels (~$41), I’m more cautious, but still bullish over the long term.

Final Thoughts

BAC continues to operate efficiently. If the bank maintains discipline and redeploys capital intelligently, the embedded tailwind from its maturing MBS portfolio could unlock significant value—especially if shares are repurchased at reasonable prices.

Disclaimer

I’ve made a ton of assumptions here and this isn’t meant to be investment advice to anyone. In fact I’m not sure I’d buy more BAC at this price, but it’s hard to tell because of where my average cost is. There are a ton of things that could happen to make my observation here irrelevant. Huge recession, trade war, civil unrest. Heck, there COULD be a run on Bank of America. It seems pretty unlikely to me but you get the point. Take the above with a grain of salt.